![[Main Media] [Funds Focus] Bridge](https://carmignac.imgix.net/uploads/article/0001/02/26ad7f7eb70cc9f1137127c5b230d8042189f9e1.jpeg?auto=format%2Ccompress&crop=faces&fit=crop&w=3840)

Carmignac Absolute Return Europe: Letter from the Fund Managers

Over the thirds quarter of 2024, Carmignac Absolute Return Europe (A EUR Acc share class) realized a negative performance of -2.19%.

Market environment

Global equity markets produced a positive return in Q3 but the headline numbers mask a very tumultuous period of volatility during the quarter driven by a series of conflicting macro forces.

After a positive start to the early part of July, a toxic combination of weaker US data and a spike in the Japanese Yen following an interest rate rise in Japan set off a spectacular chain of events in the first few days of August which forced systematic funds to unwind their highly leveraged Yen carry trade, creating a significant global equity degrossing with long positions forcibly liquidated and covering of short positions.

Japanese equities had their worst one day sell since 1987 which was followed by the biggest upside move since 2008 and this had a knock-on effect across the globe. The VIX volatility risk indicator was propelled to a level above 60, a level only seen 3 times in the last 35 years (2008 GFC & Covid sell off in March 2020).

After an aggressive sell off, markets steadily recovered as central banks pivoted in a more dovish direction with the Fed, the ECB and the Bank of England embarking on rate cuts. In addition, US economic data which had been a cause for concern showed signs of improvement which allayed fears of a US recession. This was followed in September by another material macro event in the form of an announcement of significant economic stimulus measures from the Chinese government, which catalysed a surge in Chinese equities and China exposed stocks in European markets. On the last day of the quarter alone, Chinese equities rallied 8.3% taking the main Chinese index from a 5 year low to a 1 year high. The knock-on effect in Europe was heavy selling of year-to-date winners and defensive stocks, as investors sought to reduce multiyear underweights/shorts in China exposed names. These macro forces unleashed a series of sectoral rotations with winners one month becoming the losers next month and vice versa which acted as a short circuit to fundamental stock picking. Few, if any investors around the globe, including us were positioned for this.

Over the quarter the best performing sectors in Europe were Communications, Real Estate, Industrials and Utilities while the main detractors were Technology, Consumer Staples, Energy and Healthcare.

Performance review

These macro driven rotational forces acted as a short circuit to our fundamental stock picking and in this difficult environment the fund lost around 2%, with August seeing the worst impact. Any positive returns from our defensively positioned long book were more than offset by the losses in our single stock shorts and portfolio hedges which were squeezed higher by aggressive rotational short covering.

Within the portfolio, the most positive sector returns came from Communications, Real Estate, Industrials , Financials and Utilities while the main detractors were Technology, Consumer Staples, Energy, and Healthcare.

On a stock level, the main contributors were:

| Long position in Fresenius | Positive numbers drives rerating |

| Long position in Deutsche Telekom | Earnings beat and improving cash returns |

| Long position in National Grid | Recovery from sell off ahead of capital increase |

| Long position in Nexans | Significant contract signed for underwater power cable |

| Long position in Vonovia | Asset disposals refinance balance sheet, German real estate market bottoming |

On a stock level, the main detractors were:

| Long position in ASML | Disappointing order numbers and concerns over US restrictions on sales to China |

| Long position in Novo Nordisk | Long-market worried about risk of new entrants in the GLP-1 market |

| Long position in National SK Hynix | Profit taking in AI and weak macro impacting legacy business |

| Long position in Alphabet | Disappointing numbers |

| Long position in STMicroelectronics | Q2 earnings below expectations |

Much of the portfolio activity for Q3 was driven by risk management in what were incredibly challenging conditions for long /short investors. Whenever the portfolio is not working, we always act to reduce risk by managing down gross exposure and in this case we took our gross exposure down from 150% at the end of June to 120% at the end of July and then down to 100% in August in order to preserve capital, until such time as the macro volatility calms down and that stocks can return to a more normal behaviour and where again we feel the risk reward is compelling enough to can take advantage of opportunities created by the moves.

Our net exposure fluctuated between 10% and mid-20%s. The principal adjustments to the portfolio were tactical reductions in longs in Technology and Healthcare and profit taking in Utilities which had performed very strongly on the back of falling bond yields. Elsewhere we reduced short positions in Consumer discretionary, Industrials and Materials and added to Financials, mainly Banks and to Real Estate names which are significant beneficiaries of falling interest rates.

What is our outlook for the coming months?

As we now embrace the challenges and opportunities of the last quarter of the year, whether the FED cuts a further 50 or 75bps before the end of the year, or indeed the ECB accelerates their pace or not, it really shouldn’t matter too much as the rate cycle has inflected. However, unlike these recent weeks when markets have quickly shifted from one narrative to another, for example from ‘the Fed being behind the curve’ to ‘ a goldilocks’ scenario and back again, we should hopefully begin to see a more stable macro trend emerging. Instead, the bigger challenge for equity investors in the coming weeks will be, how to best navigate the most important quarterly reporting season of the year. Usually, at the 9-month stage is when we tend to see a much higher frequency of corporate profit warnings (or upgrades), vs any point earlier in the year. Some refer to it as ‘ the confession season’.

This is simply due to the timing of the year, by which time management teams come to realize that time is running for them to either meet or beat their full year guidance & fiscal outlook expectations. In addition, it is also the time when most sell side analysts really begin to properly adjust their growth forecasts for the coming year ahead, so lots of earnings expectation risk which should be a fertile period for long/short investing.

Even though, uncharacteristically, and unexpectedly September was a relatively strong month for equities, given the current ‘setup’, post all these rotational forces, we believe the upcoming Q3 season will be very ‘rich’ of opportunities. We can think of several sectors, whereby the top-down narrative might be in direct conflict with the short-term bottom up. For example, some Luxury stocks have seen big rallies of their lows on the back of China stimulus, but can they sustain those gains against weak Q3’s with possibly further downgrades to 25’ estimates?

Similarly, with some of the Consumer discretionary or Industrials stocks, we face the same question and challenge. Many of these names too have rebounded, particularly Miners & Industrials in Europe that are indirectly or directly linked to China. And the main question we must ask, is how much of this rebound is due to China stimulus vs expectations of lower rates and a turn of the cycle in 2025? Meanwhile, what we do know, meeting with the management teams of several of these companies during the many conferences in September, is that their messaging is at best cautious, and with very limited visibility. In some cases, the lack of visibility is also likely to be linked to the upcoming US election, where seemingly decisions on spending, capex plans etc. are put on hold until we know the outcome of who will take the White House in November. Could that result in a rush of spending, new investment plans and announcement post the election? It is possible.

Therefore, this reporting season is likely to be particularly challenging, but equally, will offer significant opportunities both for our short and long book. This is why we are deliberately running a relatively low gross exposure at around 100% currently, keeping lot of ‘dry powder’ ready to deploy once we see the initial signs to how this reporting season will emerge, sector by sector, stock by stock. We are confident that this level of flexibility will give us the best chance to really capture as much as possible in what tends to be the best period of the whole year for alpha.

On a sector level, we stick with most of our defensive, structural Technology and Communication names, such as Meta, Amazon, Google, Microsoft & SAP. However, our weightings in more cyclical Technology names (semis) have been reduced overall and is currently mainly focused in semi equipment names, such as ASML and ASM International. Further, we’ve just recently sold our long in Nvidia post the rally in the shares but retain upside in the name through call options.

In Healthcare, a sector which has been a drag on our returns during Q2, we’ve reduced our exposures in the GLP1 names, both Novo Nordisk and Zealand. These stocks have clearly been used to fund sector rotation, and whilst we still believe in the long-term narrative for these names, it has become abundantly clear, that they now need new positive catalysts to again begin to perform. Thus, we believe Q3’s will be a big test for them, alongside new drug read outs. But with Novo having sold off by some -25% from its peaks, we do believe expectations are now possibly too low and that the stock should soon inflect. Our largest healthcare stock is today Fresenius SE which we believe is defensive and still much too cheap (11x PE).

Meanwhile, for many of the more cyclical sectors, Consumer discretionary, Industrials, Miners & Chemicals, we are today more balanced than at any time earlier in the year. This is mainly because several of our short positions in these sectors have now played out, and we subsequently taken profits. Or in some cases, it is because we simply don’t yet know what level of patience the market will ‘display’ between wanting to buy these names into a recovery next year vs likely poor Q3’s, with further FY24 downgrades?

Also is worth noting that our overall non-EU exposure is limited to ca 15% of our total gross exposure.

Finally, we continue to be net long of financials, mainly European Banks. Recent meetings with management teams of these Banks and speaking to analysts, have increased our conviction in them, despite in some cases already strong year-to-date performances. In addition, we believe that for European banks, Q3 earnings risk is relatively low vs most other European sectors. We continue to argue that due to their strong capital bases, hedged net interest incomes exposures, rich cash distribution, low valuations and more recently the emergence of European banks M&A, selective banks stocks still offer good upside from here.

Carmignac Absolute Return Europe

An opportunistic and style agnostic long/short approach to European equitiesDiscover the fund pageCarmignac Absolute Return Europe A EUR Acc

- Aanbevolen minimale beleggingstermijn

- 3 jaar

- SFDR-fondscategorieën**

- Artikel 8

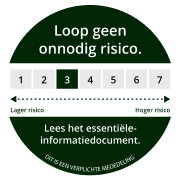

- Risicoschaal*

*Risicocategorie van het KID (essentiële-informatiedocument) indicator. Risicocategorie 1 betekent niet dat een belegging risicoloos is. Deze indicator kan in de loop van de tijd veranderen. **De Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is een Europese verordening die vermogensbeheerders verplicht hun fondsen te classificeren zoals onder meer: artikel 8 die milieu- en sociale kenmerken bevorderen, artikel 9 die investeringen duurzaam maken met meetbare doelstellingen, of artikel 6 die niet noodzakelijk een duurzaamheidsdoelstelling hebben. Voor meer informatie, bezoek: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=nl.

Voornaamste risico's van het Fonds

Kosten

- Instapkosten

- 4,00% van het bedrag dat u betaalt wanneer u in deze belegging instapt. Dit is het hoogste bedrag dat u in rekening zal worden gebracht. Carmignac Gestion rekent geen instapkosten. De persoon die u het product verkoopt, informeert u over de daadwerkelijke kosten.

- Uitstapkosten

- Wij brengen voor dit product geen uitstapkosten in rekening.

- Beheerskosten en andere administratie - of exploitatiekos ten

- 2,30% van de waarde van uw belegging per jaar. Dit is een schatting op basis van de feitelijke kosten over het afgelopen jaar.

- Prestatievergoedingen

- 20,00% max. van de meerprestatie als het rendement positief is en de netto-inventariswaarde de high-water mark overschrijdt. Het feitelijke bedrag zal variëren naargelang van de prestaties van uw belegging. De schatting van de totale kosten hierboven omvat het gemiddelde over de afgelopen vijf jaar, of sinds de introductie van het product als dat minder dan vijf jaar geleden is.

- Transactiekosten

- 0,98% van de waarde van uw belegging per jaar. Dit is een schatting van de kosten die ontstaan wanneer we de onderliggende beleggingen voor het product kopen en verkopen. Het feitelijke bedrag zal varieert naargelang hoeveel we kopen en verkopen.

Rendement

| Carmignac Absolute Return Europe | 2.5 | -8.0 | 8.9 | 14.6 | 4.4 | -1.3 | 5.2 | 12.6 | -6.4 | 0.0 |

| Carmignac Absolute Return Europe | - 1.5 % | + 2.9 % | + 3.3 % |

Bron: Carmignac op 29 nov. 2024.

In het verleden behaalde resultaten zijn geen garantie voor de toekomst. De resultaten zijn netto na aftrek van kosten (inclusief mogelijke in rekening gebrachte instapkosten door de distributeur) .

Recente analyses

Onze Merger-Arbitrage-strategieën bekroond als 'Best New Launch'

Beste ESG Alternative Fund award gaat naar Carmignac

Belangrijke wettelijke informatie

Reclame. Raadpleeg het document essentiële informatiedocument /prospectus voordat u een beleggingsbeslissing neemt. Dit document is bestemd voor professionele cliënten.

Dit document mag zonder voorafgaande toestemming van de Beheermaatschappij niet geheel of gedeeltelijk worden gereproduceerd. Het is geen aanbod tot inschrijving, noch een beleggingsadvies. Het is niet bedoeld als boekhoudkundig, juridisch of fiscaal advies, en mag derhalve ook niet als zodanig worden beschouwd. Het is uitsluitend ter informatie aan u verstrekt en het mag niet als betrouwbaar meetinstrument worden gezien voor het beoordelen van de verdiensten van het beleggen in effecten of belangen waaraan in dit document wordt gerefereerd, noch mag het voor andere doeleinden worden gebruikt. De in dit document opgenomen informatie kan onvolledig zijn en kan zonder voorafgaande kennisgeving worden gewijzigd. Deze informatie dateert van de datum waarop dit document is geschreven en is afkomstig van zowel bedrijfseigen als niet-bedrijfseigen bronnen die Carmignac betrouwbaar acht, maar is niet per se compleet en gegarandeerd nauwkeurig. Carmignac als organisatie, haar management en individuele medewerkers garanderen geenszins de nauwkeurigheid en betrouwbaarheid van deze informatie en stellen zich op generlei wijze aansprakelijk voor vergissingen en weglatingen (ook niet in geval van nalatigheid, van wie dan ook).

In het verleden behaalde resultaten zijn geen garantie voor de toekomst.

De resultaten zijn netto na aftrek van kosten (inclusief mogelijke in rekening gebrachte instapkosten door de distributeur). Als gevolg van wisselkoersschommelingen kan het rendement van aandelenklassen waarvan het wisselkoersrisico niet is afgedekt, stijgen of dalen.

Verwijzingen naar bepaalde waarden of financiële instrumenten zijn voorbeelden van beleggingen die in de portefeuilles van de fondsen van Carmignac aanwezig zijn of waren. Deze verwijzingen hebben niet tot doel om directe beleggingen in die instrumenten aan te moedigen en zijn geen beleggingsadvies. De Beheermaatschappij is niet onderworpen aan het verbod op het uitvoeren van transacties met deze instrumenten voorafgaand aan de verspreidingsdatum van de informatie. De portefeuilles van de fondsen van Carmignac kunnen op ieder moment worden gewijzigd.

De verwijzing naar een positionering of prijs, is geen garantie voor de resultaten in de toekomst van de UCIS of de manager. De aanbevolen beleggingshorizon is een minimale horizon en geen aanbeveling om uw beleggingen aan het einde van deze periode te verkopen.

Morningstar Rating™ : © Morningstar, Inc. Alle rechten voorbehouden. De informatie in dit document is eigendom van Morningstar en/of zijn informatie leveranciers, mag niet gekopieerd of verspreid worden en wordt niet gegarandeerd als zijnde exact, volledig of geschikt op dit moment. Morningstar noch zijn informatieleveranciers zijn verantwoordelijk voor eventuele schade of verliezen als gevolg van het gebruik van deze informatie.

Voor bepaalde personen of landen kan de toegang tot de fondsen aan beperkingen onderhevig zijn. Dit document richt zich niet tot personen die vallen onder een rechtsgebied waar (vanwege de nationaliteit of woonplaats van de desbetreffende persoon of om andere redenen) de informatie in dit document of de beschikbaarheid daarvan verboden is. Personen voor wie een dergelijk verbod geldt, hebben geen toegang tot deze informatie. Welke belastingen er worden geheven, hangt van de situatie van het individu af. De fondsen zijn niet geregistreerd voor de retailmarkt in Azië, Japan en Noord-Amerika, en zijn niet geregistreerd in Zuid-Amerika. Carmignac Fondsen zijn in Singapore als buitenlandse belegging met beperkende voorwaarden geregistreerd (uitsluitend voor professionele cliënten). De fondsen zijn niet geregistreerd in het kader van de Amerikaanse Securities Act van 1933. In overeenstemming met de Amerikaanse Regulation S en de FATCA mag het fonds niet ten gunste van of uit naam van een "U.S. person" direct of indirect aangeboden of verkocht worden. Bij de beslissing om in het gepromote fonds te beleggen moet rekening worden gehouden met alle kenmerken of doelstellingen ervan zoals beschreven in het prospectus. Het prospectus, de KID, de NIW en de jaarlijkse periodieke verslagen van het fonds zijn beschikbaar op www.carmignac.com, of op aanvraag bij de Beheermaatschappij. De risico's, vergoedingen en lopende kosten zijn beschreven in de KID (Essentiële informatiedocument). De KID dient voorafgaand aan iedere inschrijving aan de inschrijver beschikbaar te worden gesteld. De inschrijver dient de KID te lezen. Beleggers kunnen hun kapitaal gedeeltelijk of geheel verliezen aangezien het fondskapitaal niet wordt gegarandeerd. Aan de fondsen is een risico van kapitaalverlies verbonden. De beheermaatschappij kan op elk moment besluiten de marketing in uw land stop te zetten. Beleggers kunnen toegang krijgen tot een samenvatting van hun rechten in het Nederlands via de volgende link in sectie 6 getiteld "Samenvatting van de beleggersrechten"

Carmignac Portfolio verwijst naar de subfondsen van Carmignac Portfolio SICAV, een beleggingsmaatschappij naar Luxemburgs recht die voldoet aan de ICBE-richtlijn.

De Fondsen zijn beleggingsfondsen in contractuele vorm (FCP) conform de UCITS-richtlijn of AFIM-richtlijn onder Frans recht.