Carmignac Sécurité : Letter from the Fund Manager

Carmignac Sécurité lost –4.39% in the first quarter of 2022, while its reference indicator was down –1.03%.1

The bond market today

The inflationary pressures that emerged in 2021 didn’t ease in the first quarter. On the contrary – inflation has become the primary concern of central banks on both sides of the Atlantic, and therefore also of investors. Bond markets just recorded one of their worst quarters in the past 50 years, while the main sovereign bond indices in the developed world experienced their biggest cumulative losses since they were created. In managing our Carmignac Sécurité fund, we mitigated the effects of the higher yields and downturn in the corporate bond market by flexibly adjusting our modified duration and asset allocation. However, it was our Russian investments – and especially Gazprom, which just a few months ago was considered one of the biggest beneficiaries of the higher gas prices and the energy transition in a post-Covid world – that detracted the most from our Q1 performance. We’ve scaled back our exposure to Russia since the war broke out; it accounted for just 1% of the Fund’s assets at end-March, down from over 3.5% at the start of the year.

The macroeconomic climate changed quickly during the first quarter. Global GDP growth continued at a fairly brisk pace thanks to a weaker-than-expected Omicron wave, and job figures in the US – and to a lesser extent in Europe – were strong with unemployment down to levels approaching full employment. Inflation is now the biggest worry. The US Federal Reserve had already shifted its stance, trading in its patience for a more hawkish approach, and the ECB decided to follow in its footsteps at its March meeting. The higher inflation is no longer being dubbed “transitory,” as central banks are moving to quickly normalise their monetary policies and stem the rise in consumer prices. The outbreak of hostilities in Ukraine only reinforced this trend. Although the war poses a threat to economic growth, it is also having an asymmetric impact on inflation, pushing up commodities prices and intensifying the stress on supply chains – and we learned during the pandemic that this kind of stress is highly inflationary. The latest year-on-year inflation figures are startling: over 7% in the eurozone and nearly 8% in the US. In addition, economists and investors keep pushing back their forecasts for when these rates will fall to levels more acceptable to central bankers.

Somewhat counter-intuitively, risk assets like corporate bonds and eurozone-periphery credit spreads held up better than sovereign bonds in the current climate. The yield on 2-year Bunds rose 60 bps during the quarter (to close just under zero, at –0.07%), and credit spreads (measured by the iTraxx Crossover index) widened by “just” 80 bps. Even more surprisingly, those credit spreads ended the quarter slightly below where they were on 24 February – the day of Russia’s invasion. It’s as if investors think the real economy will be unphased by the consequences of the conflict. Spreads on sovereign debt, like those in Italy, followed a similar pattern and were affected much more by the ECB’s decision to halt its asset purchases than by the war in Ukraine.

Portfolio allocation

Against this backdrop, we made considerable changes to our portfolio in the first quarter.

First, in terms of modified duration. We steadily reduced it in January to the point where it was negative in early February. We then increased it sharply but temporarily, to nearly 3, on fears that Russia’s invasion of Ukraine would delay action by central banks and prompt a flight to safe-haven assets. We then quickly pared it back towards zero after hearing the statements from central bankers. The modified duration of our portfolio ended the quarter close to zero, and still with a long bias on corporate paper hedged using short positions on core sovereign bonds.

In our inflation strategies, we again initiated a position on higher inflation in mid-February, first on the 5-year segment which we later transferred to the 10-year segment (as we simultaneously increased the exposure).

In corporate bonds, we took advantage of the many issues on the primary market at the start of this year to start investing the cash we’d built up at the end of last year. But then we reversed course in late February – partly by hedging our portfolio with protection on credit indices, but mostly by selling a large part of our bond holdings. Given the more hawkish tone at the ECB (meaning higher interest rates) and the much more uncertain economic climate (meaning higher credit spreads), we preferred to build up a pool of cash that we can invest later at more attractive prices. We shrank our allocation to bonds held directly (i.e., excluding CLOs) by 15% between its high point and end-March, so that it’s now less than 50% of the Fund’s assets. In addition, at quarter-end we had hedges on over 13% of our high-yield investments.

We reduced our exposure to Russia during the quarter. Much of the decline in Russia’s weighting in our portfolio can be attributed to the fall in the prices of those assets, but we also sold some of our holdings when the war broke out. We disposed of our Lukoil and Norilsk Nickel bonds and some of our Gazprom bonds. However, bond prices quickly dropped to levels that we believe are below the recovery rate in the event of default. We therefore decided to hold on to our remaining paper, which accounted for 1% of the portfolio at end-March (70% Gazprom bonds and 30% Russian sovereign debt). All these issues are denominated in euros, except for one Gazprom bond denominated in Swiss francs. Our Russian investments were behind most of the Fund’s underperformance in the first quarter.

Outlook

The four main performance drivers for our Fund in the coming months will be:

- A lower modified duration coupled with credit protection, which should let us withstand or even gain from further rises in interest rates, inflation, and credit spreads as central banks withdraw support more quickly.

- A carry rate of nearly 2%, which is considerably higher than in recent years despite the circumstances; this carry is comprised mainly of corporate bonds in our three high-conviction themes: energy, banks, and CLOs.

- An over 30% allocation to cash and cash equivalents, which will let us seize opportunities quickly when bond prices start factoring in much of the monetary-policy normalisation.

- A residual exposure to Russia (mainly Gazprom), which we will reduce further when valuations are no longer being impacted by a dislocated market and extremely punitive implied recovery rates.

Carmignac Sécurité

Flexible, low duration solution to challenging European marketsDiscover the fund pageCarmignac Sécurité AW EUR Acc

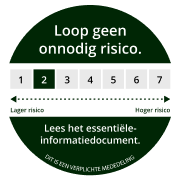

- Aanbevolen minimale beleggingstermijn

- 2 jaar

- SFDR-fondscategorieën**

- Artikel 8

- Risicoschaal*

*Risicocategorie van het KID (essentiële-informatiedocument) indicator. Risicocategorie 1 betekent niet dat een belegging risicoloos is. Deze indicator kan in de loop van de tijd veranderen. **De Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is een Europese verordening die vermogensbeheerders verplicht hun fondsen te classificeren zoals onder meer: artikel 8 die milieu- en sociale kenmerken bevorderen, artikel 9 die investeringen duurzaam maken met meetbare doelstellingen, of artikel 6 die niet noodzakelijk een duurzaamheidsdoelstelling hebben. Voor meer informatie, bezoek: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=nl.

Voornaamste risico's van het Fonds

Rendement

| Carmignac Sécurité | 1.7 | 1.1 | 2.1 | 0.0 | -3.0 | 3.6 | 2.0 | 0.2 | -4.8 | 4.1 |

| Referentie-indicator | 1.8 | 0.7 | 0.3 | -0.4 | -0.3 | 0.1 | -0.2 | -0.7 | -4.8 | 3.4 |

| Carmignac Sécurité | + 1.4 % | + 1.3 % | + 1.0 % |

| Referentie-indicator | + 0.4 % | + 0.1 % | + 0.1 % |

Bron: Carmignac op 29 nov. 2024.

In het verleden behaalde resultaten zijn geen garantie voor de toekomst. De resultaten zijn netto na aftrek van kosten (inclusief mogelijke in rekening gebrachte instapkosten door de distributeur) .

Recente analyses

![[Management Team] [Author] Allier Marie Anne](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Allier-Marie-Anne.png?auto=format%2Ccompress&fit=fill&w=3840)